Best Ways to use the American Express Card

Looking to maximize your American Express card benefits in 2026? The American Express Card, often called the AmEx Card, offers exclusive perks that make it a standout in the credit card market. While some AmEx cards come with high annual fees, the benefits, like earning Membership Rewards points, accessing airport lounges, and enjoying travel credits, can make them well worth it. In this guide, we’ll show you how to get the most value from your AmEx card, whether you’re a frequent traveler or just want to optimize your daily spending.

How to Earn More American Express Points

One of the best ways to maximize your American Express card is by earning Membership Rewards points, a unique benefit of AmEx cards.

You can rack up points through two main channels:- Sign-Up Bonuses and Referrals: New cardholders can earn a hefty sign-up bonus, often up to 150,000 points, by meeting spending requirements. You can also earn points by referring friends, click here to learn more.

- Daily Spending: With most AmEx cards, you earn 1 point per euro spent on everyday purchases. With the American Express Platinum card, you can activate Rewards Booster. Instead of earning 1 point per euro spent, you earn 4 points per euro. (Optional add-on: €10 per month.)

Unlike many reward programs, American Express points never expire, giving you flexibility to save them for the perfect redemption. You can use your points for flights, hotel stays, gift cards, or even to offset your AmEx annual fees.

According to American Express, 1 point is worth about 0.2€, when redeemed for statement credits. However, you can get much better value by using them for travel-related expenses. In the next section, we’ll show you how to maximize the value of your AmEx rewards for travel and more.

Best Ways to Redeem AmEx Rewards with Frequent Flyer Programs

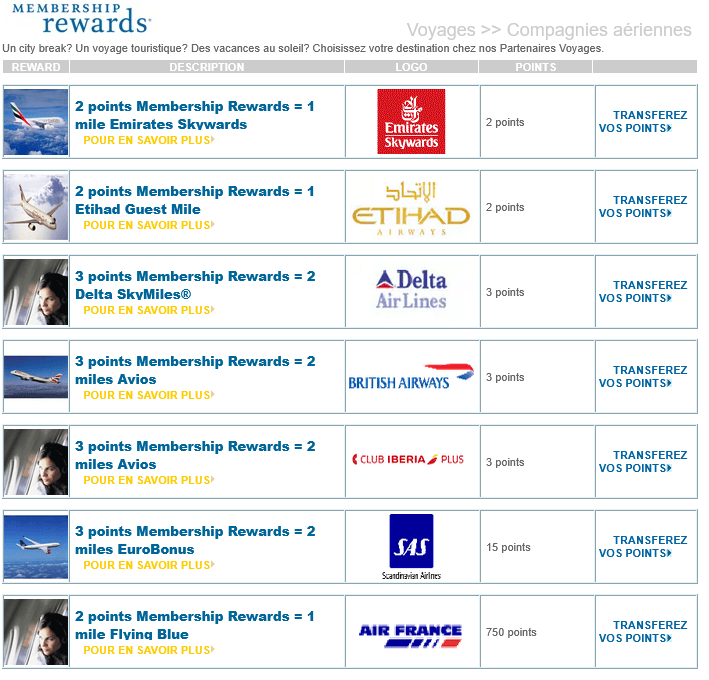

Redeeming your American Express Membership Rewards points for travel can significantly boost their value, especially when you transfer them to frequent flyer programs. AmEx Belgium/Luxembourg has partnered with seven airline loyalty programs, allowing you to convert points into miles at varying rates. Below, we break down the transfer ratios and highlight the best opportunities to maximize your AmEx rewards for flights.

AmEx Transfer Partners and Ratios

Here are the seven frequent flyer programs you can transfer your AmEx points to, along with their transfer ratios:

- Emirates Skywards (2:1): 2 AmEx points = 1 Emirates mile

- Etihad Guest (2:1): 2 AmEx points = 1 Etihad mile

- FlyingBlue (SkyTeam) (2:1): 2 AmEx points = 1 FlyingBlue mile

- British Airways Executive Club or Iberia (Oneworld) (3:2): 3 AmEx points = 2 Avios

- Delta SkyMiles (SkyTeam) (3:2): 3 AmEx points = 2 Delta miles

- Scandinavian Airlines (SAS) EuroBonus (SkyTeam) (3:2): 3 AmEx points = 2 SAS miles

Hidden Trick: How to Book Star Alliance Flights with AmEx Points

Even though no Star Alliance airline appears on the official AmEx Belgium/Luxembourg transfer list, there is a powerful workaround to redeem your AmEx points for Star Alliance flights, including Lufthansa, SWISS, ANA, Singapore Airlines, and more.

You can do this by transferring your points through Marriott Bonvoy, which partners with United Airlines MileagePlus (2:1 ratio).

How the Trick Works:

1. Transfer AmEx → Marriott Bonvoy (1:1 ratio)

60,000 American Express points → 60,000 Marriott points

2. Transfer Marriott → United Airlines (3:1 ratio + bonus)

United gives a 10,000-mile bonus for every 60,000 Marriott points transferred in one transaction.

- Standard conversion: 60,000 Marriott → 20,000 United miles (3:1)

- Bonus: +10,000 miles

- Total: 30,000 United miles

Note: You only receive the 10,000-mile bonus when you transfer 60,000 Marriott points at once.

Meaning Effective Ratio (With Bonus = 2:1)

- 60.000 Amex → 60,000 Marriott → 30,000 United miles

By routing your AmEx points through Marriott to United, you unlock the full Star Alliance network:

- Lufthansa

- SWISS

- Austrian

- LOT

- TAP Air Portugal

- Turkish Airlines

- ANA

- Singapore Airlines

- And many more

United MileagePlus also typically does not charge fuel surcharges, giving you better value on long-haul premium cabin redemptions.

Transferring your points to one of these programs can unlock incredible flight deals, especially if you’re strategic about timing and destinations. Let’s explore an example to show how much value you can get.

Example for Reward Flight cost: British Airways Avios for Transatlantic Business Class

British Airways Executive Club (Oneworld) is great option for redeeming AmEx points, especially for one-way flights where the value per point can soar. Let’s break down the numbers for a round-trip Business Class flight from London Heathrow (LHR) to New York (JFK):

- Cash Price: A round-trip Business Class ticket typically costs around €3000.

- Avios Cost (Off-Peak): 160,000 Avios + €375 in taxes.

- Avios Cost (Peak): 180,000 Avios + €375 in taxes.

- AmEx Points Needed: At the 3:2 ratio, 160,000 Avios requires 240,000 AmEx points, and 180,000 Avios requires 270,000 AmEx points.

- Value per AmEx Point (Round-Trip): After subtracting taxes, the 240,000-270,000 AmEx points save you €2625, making each point worth 0.97 to 1.09 euro cents.

- One-Way Flights: One-way Business Class flights from LHR to JFK often cost €5000-€8000 in cash. Using Avios, a one-way off-peak flight costs 80,000 Avios + €200 in taxes (120,000 AmEx points). This saves you €4800-€7800, making each AmEx point worth 4.0 to 6.5 euro cents—an incredible value!

Maximize AmEx Points with Hotel Stays: Hilton Honors and Marriott Bonvoy

Transfer AmEx Points to Hilton Honors and Marriott Bonvoy

You can transfer your AmEx points to the following hotel loyalty programs:

- Hilton Honors (1:1): 1 AmEx point = 1 Hilton Honors point

- Marriott Bonvoy (1:1): 1 AmEx point = 1 Marriott Bonvoy point

On average, Hilton Honors and Marriott Bonvoy points are worth about 0.5 euro cents each when redeemed for hotel stays. However, by choosing the right properties and booking during peak periods, you can often get much higher value, sometimes doubling the worth of your AmEx points.

Example: Booking Baker’s Cay Resort with Hilton Honors Points

We recently redeemed AmEx points for a stay at Baker’s Cay Resort in Key Largo, Florida, a Hilton Honors property. Here’s how it broke down:

- Cash Price (Regular): A night at Baker’s Cay typically costs around €500.

- Cash Price (Peak Season): During the Easter holiday, the price spiked to €1000.

- Hilton Honors Points Cost: The stay required 90,000 Hilton Honors points, which equals 90,000 AmEx points at the 1:1 transfer ratio.

- Value per AmEx Point: Depending on the cash price, the 90,000 AmEx points saved us €500-€1000, making each point worth 0.55 to 1.11 euro cents.

This example shows how transferring AmEx points to Hilton Honors can yield excellent value, especially during peak travel seasons when hotel rates are higher. The same principle applies to Marriott Bonvoy, look for high-value redemptions at luxury properties or during busy periods to stretch your points further.

Top American Express Card Perks for Travelers: Elite Status Benefits

As an American Express Platinum cardholder, you can unlock exclusive travel perks that maximize your American Express card benefits, especially when it comes to hotel stays. One of the standout benefits is automatic Gold status with both Hilton Honors and Marriott Bonvoy programs. This elite status comes with valuable perks that enhance your travel experience and increase the value of your AmEx points. Let’s dive into what this means for you.

Gold Status Perks with Hilton Honors and Marriott Bonvoy

When you hold an AmEx Platinum card, you’re automatically granted Gold status in both Hilton Honors and Marriott Bonvoy programs. Here’s what you get with each:

- Hilton Honors Gold Status:

- Free breakfast for you and a guest at participating hotels.

- Room upgrades (subject to availability).

- 80% bonus on base points earned during stays.

- A complimentary 5th night free when you book a 4-night reward stay with points.

- Marriott Bonvoy Gold Status:

- Enhanced room upgrades (subject to availability).

- 25% bonus on base points earned during stays.

- Late checkout up to 2 PM (subject to availability).

- Welcome gift (points or amenity, depending on the property).

These perks not only make your hotel stays more comfortable but also increase the overall value of your AmEx points. For example, the free breakfast and room upgrades can save you hundreds of euros on a single trip, while the 5th night free with Hilton Honors effectively stretches your points by 20% for longer stays.

Tip: To take full advantage of these benefits, enroll in the Hilton Honors and Marriott Bonvoy programs through your AmEx account and link your Platinum card to activate your Gold status. Then, book directly with the hotel to ensure you receive all elite perks.

Free Airport Lounge Access with Your AmEx Card

One of the most luxurious perks of owning an American Express card is airport lounge access, a benefit that can transform your travel experience. Whether you’re a Platinum or Gold cardholder, AmEx offers access to a variety of lounges worldwide, providing gourmet food, craft cocktails, comfortable seating, and more. Here’s how to maximize your American Express card benefits with lounge access and elevate your time at the airport.

American Express Centurion Lounges for Platinum Cardholders

As an American Express Platinum cardholder, you get complimentary access to the exclusive American Express Centurion Lounges. These premium lounges are known for their upscale amenities, including:

- Gourmet food prepared by renowned chefs.

- Craft cocktails and a curated selection of wines.

- Comfortable seating areas, workspaces, and even spa services at select locations.

Centurion Lounges are available at major airports like New York (JFK), Los Angeles (LAX), and London Heathrow (LHR). You can also bring up to two guests for free, making it a great perk for family or business travel.

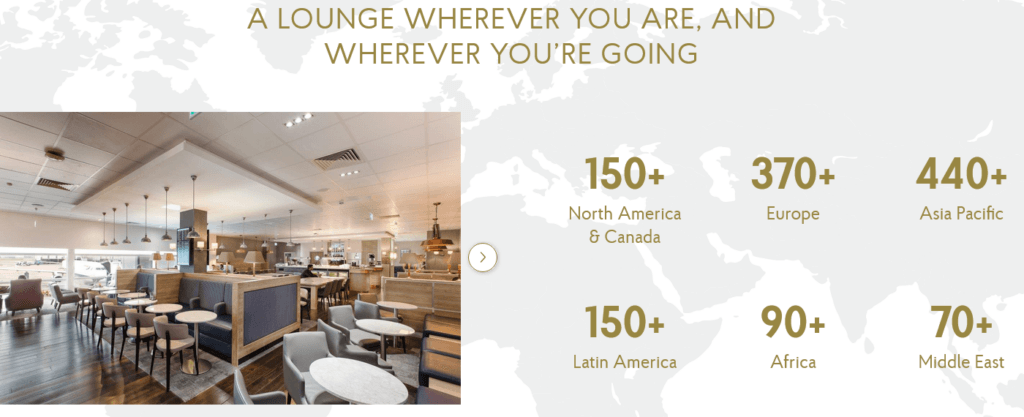

Priority Pass Access with Platinum and Gold Cards

American Express also partners with Priority Pass, giving you access to over 1,500 lounges worldwide. The benefits vary depending on your card:

- AmEx Platinum Card: You receive a complimentary Priority Pass membership (valued at €459 annually), which grants unlimited access to Priority Pass lounges for you and a guest at no additional cost.

- AmEx Gold Card: You get four free lounge visits per year to Priority Pass lounges, and you can bring a guest for free during those visits. Additional visits cost a small fee (typically €30 per person).

Priority Pass lounges offer a range of amenities to make your layover more enjoyable:

- Free Wi-Fi for staying connected.

- Snacks, full meals, and self-serve restaurants (at select locations).

- Complimentary drinks, including alcoholic beverages.

- Comfortable seating, quiet areas, and even showers at some lounges.

Tip: To activate your Priority Pass membership, enroll through your AmEx account and download the Priority Pass app to find lounges at your departure airport. Always check the guest policy, as some lounges may have restrictions during peak hours.

Savor the Flavor: AmEx Dining Credits for Platinum and Gold Cardholders

Another way to maximize your American Express card benefits is through dining credits, a perk that lets you enjoy meals at top restaurants in the Benelux region. Both AmEx Platinum and Gold cardholders can take advantage of this benefit, with credits that can be used at specially selected restaurants in Belgium, the Netherlands, and Luxembourg. Here’s how the dining credit works for each card and how you can make the most of it.

AmEx Platinum Dining Credit: Up to €300 Annually

As an AmEx Platinum cardholder, you can enjoy a dining credit that covers a lunch or dinner for two (including two courses) at participating restaurants in the Benelux region. Here’s what you get:

- Frequency: Three dining experiences per year.

- Value: Up to €100 per dining experience, totaling €300 annually.

- Eligible Locations: Specially selected restaurants in Belgium, the Netherlands, and Luxembourg.

This benefit is perfect for food lovers or those looking to celebrate a special occasion while traveling or at home. With €300 in annual credits, you can treat yourself and a guest to memorable meals without spending a dime out of pocket.

AmEx Gold Dining Credit: €100 Annually

AmEx Gold cardholders also get a dining credit, though it’s structured differently:

- Frequency: Two €50 credits per year, one every six months.

- Schedule: €50 from January to June, and €50 from July to December.

- Total Value: €100 annually.

- Eligible Locations: Selected restaurants in Belgium, the Netherlands, and Luxembourg.

This €100 annual credit is a great way to enjoy a meal on AmEx, whether you’re dining locally or exploring the Benelux region during your travels.

Tip: To use your dining credit, check the list of participating restaurants in your AmEx account or app, and make a reservation in advance. Be sure to use your credit before each period expires (June 30 for the first €50, December 31 for the second €50 for Gold cardholders) to avoid missing out!

Why the AmEx Platinum Card Is the Best Choice for Travelers

The American Express Platinum Card stands out as a premium choice for travelers in Belgium and Luxembourg, offering a suite of benefits that can maximize your American Express card benefits. From complimentary airport lounge access to the ability to book hotel stays and reward flights with AmEx points, this card is designed for frequent travelers who value luxury and convenience. Plus, it includes a comprehensive travel insurance package, covering everything from trip cancellations to medical emergencies, making it one of the top credit cards for travelers.

Frequently Asked Questions

Here are some common questions about maximizing your American Express card benefits:

- How do I earn more AmEx points?

You can earn points through sign-up bonuses, referrals, and daily spending, up to 4 pints per 1 € spent. Some cards offer bonus points in categories like dining or travel, check your card’s terms for details. - What’s the best way to redeem AmEx points?

Transferring points to frequent flyer programs (like United Airlines, Air France or British Airways) or hotel programs (like Hilton Honors) often provides the highest value, especially for Business Class flights or luxury hotel stays. - What lounges can I access with an AmEx Platinum card?

Platinum cardholders get access to American Express Centurion Lounges and Priority Pass lounges (over 1,500 worldwide), with unlimited visits for you and a guest. - How do I use the AmEx dining credit?

Platinum cardholders get up to €300 annually for dining at selected Benelux restaurants, while Gold cardholders get €100. Check participating restaurants in your AmEx account and use your credit before it expires.

Note: All deals are personally verified and bookable directly with airlines or reputable travel partners. Prices and availability can change quickly, we never sell flights ourselves.